What Do I Need To Know About FSAs and HSAs?

Navigating benefits packets and health insurance plans can be confusing. But even after you’ve selected your plan for the year, you’re not quite finished yet — there are still a few more decisions to make. Two acronyms you’ve probably seen floating around your open enrollment paperwork are FSA and HSA. Both let you set pre-taxed money aside to pay for medical expenses like copays, prescription drugs, and a variety of over-the-counter eligible expenses, but there are a few key differences that are important to know when making insurance decisions.

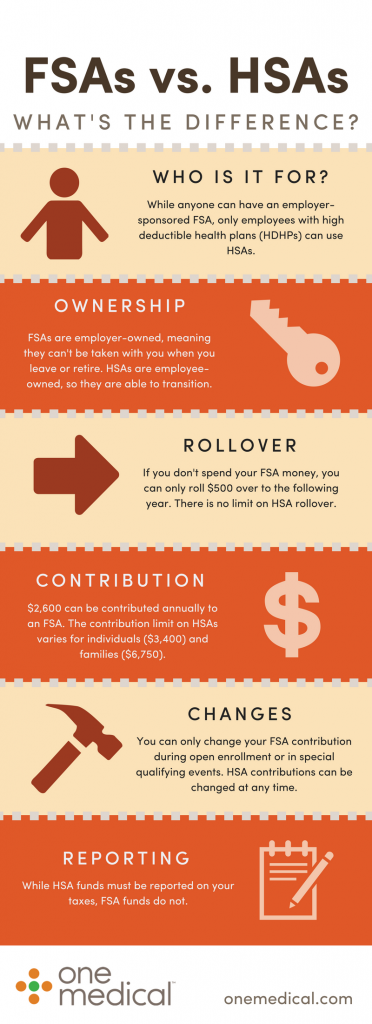

A flexible spending account, or FSA, is an account established by an employer where employees can set money aside pre-tax for certain healthcare expenses. While FSA contributions come from an employee’s pre-tax income, it is ultimately the employer who owns the account.

There are contribution limits on FSAs — in 2017, the FSA contribution limit is $2,600, and employers can set a lower limit if they want. If your employer contributes to your FSA as a benefit, those employer contributions do not count towards the limit. If you don’t use all of your FSA funds by the end of the year, up to $500 of it can roll over to the next year. Since FSAs are owned by your employer, they don’t transition with you if you change jobs or retire, and there’s no need to report any of your funds on your taxes. Your FSA contribution can only be changed once a year (during open enrollment) or in special qualifying events.

A health savings account, or HSA, is an employee-owned account that allows you to set money aside pre-tax for healthcare expenses, but it is only for employees on high deductible health plans (HDHPs). If your deductible is more than $1,300 (for an individual) or $2,600 (for a family), you have an HDHP.

Like FSAs, HSAs have a contribution limit, but it’s higher — $3,400 for an individual or $6,750 for a family. If you’re over 55, you can contribute an additional $1,000 annually to your HSA. And there’s no limit on rollover, so you don’t have to worry about losing any of the money you’ve contributed. Since HSAs are employee-owned, they function like a bank account — if you move to a new job or retire, your HSA comes with you (you may have to pay administrative fees on it, though). That also means that, unlike FSAs, HSA funds do need to be reported on your taxes using Form 8889. You can change your HSA contribution at any point in time.

Still not sure what the best health insurance plan is best for your needs? Check out the rest of our open enrollment series to get all of the information you need to make the right decision for you.

The One Medical blog is published by One Medical, a national, modern primary care practice pairing 24/7 virtual care services with inviting and convenient in-person care at over 100 locations across the U.S. One Medical is on a mission to transform health care for all through a human-centered, technology-powered approach to caring for people at every stage of life.

Any general advice posted on our blog, website, or app is for informational purposes only and is not intended to replace or substitute for any medical or other advice. 1Life Healthcare, Inc. and the One Medical entities make no representations or warranties and expressly disclaim any and all liability concerning any treatment, action by, or effect on any person following the general information offered or provided within or through the blog, website, or app. If you have specific concerns or a situation arises in which you require medical advice, you should consult with an appropriately trained and qualified medical services provider.